Germany

There is an increasing number of digital native media outlets in Germany, ranging from investigative outlets to YouTube channels aimed at audiences from minority groups, and a variety of new local outlets. These directly challenge the more conservative publicly funded broadcasters by reaching young or niche-interest audiences. Through the platform Steady, paid subscription models have become popular, though many publications still rely on grants or start-up funding to sustain themselves.

GENERAL INFORMATION

Press

freedom

ranking

Internet

penetration

POPULATION

Media organisations

in the Directory

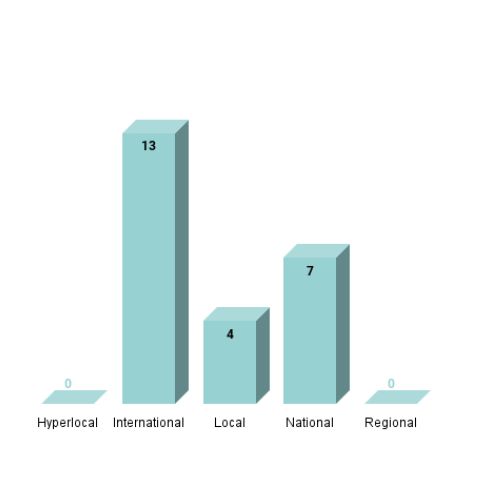

TYPE OF COVERAGE

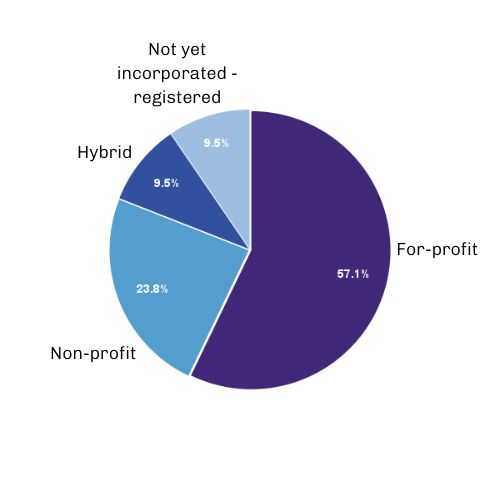

TYPE OF ORGANISATION

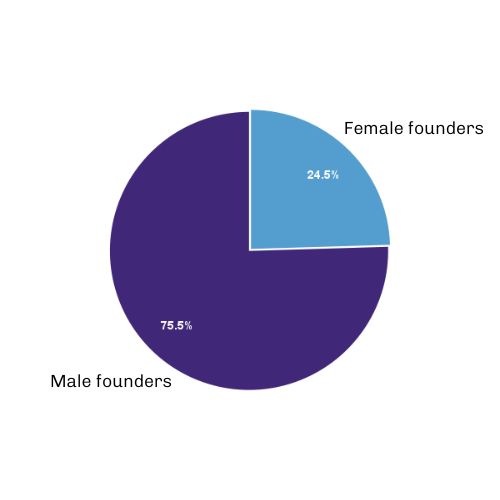

GENDER OF FOUNDERS

Press freedom

Over 80 attacks on journalists in Germany were recorded in 2021, over 65% of them at demonstrations against Covid-19 measures, according to Reporters Without Borders. Police too, were actively involved in violence against journalists, and have been accused of not defending journalists under attack by demonstrators, notes the organisation.

SLAPPs (strategic lawsuits against public participation) have also been increasingly used as a legal means to limit freedom of the press, the most prominent case of which counts numerous lawsuits documented against journalists and media by the Adelshaus (royal house) Hohenzollern alone.

Following a claim by the Gesellschaft für Freiheitsrechte (Society for Civil Rights) in 2017, the Federal Constitutional Court in 2022 also confirmed the right of journalists to use leaked data provided by whistleblowers, initially seen as under threat by the data theft section 202d of the Criminal Code introduced in 2015. However in the digital realm, the new 2021 cybersecurity law, as well as governmental use of the spy software Pegasus, have been highlighted as significant threats to freedom of the press.

Market structure and dominance

Reporters Without Borders’ annual report notes a worrying reduction in the diversity of the German media sector, especially in newspapers, but highlights the continued strength of publicly funded media both at federal and state level. Across all platforms, public broadcasters capture nearly 30% of audiences, stretching to over 50% for both radio and television, according to a 2021 report by Germany’s media authorities. Economic pressures have led to further consolidation, especially in the print sector. In 2021, for example, the 10 largest newspaper groups accounted for 50.8% of circulation, according to the Euromedia Ownership Monitor. Overall, Bertelsmann, Burda, ARD, United Internet and Axel Springer account for 40.5% of market share, notes the German media authorities’ report. The threat this consolidation poses to press freedom was most prominently seen by the publisher Dirk Ippen reportedly preventing publication of investigative research around sexual harassment charges against the tabloid Bild’s editor-in-chief Julian Reichelt.

How media is funded

The dominant public interest media organisations are funded through monthly broadcast contributions amounting to over €8 billion. In addition, €2.3 million was granted by the Ministry of Culture and Media to projects providing structural media support. A further stimulus package, as well as a legal framework for non-profit journalism, have been promised as part of the German governing coalition’s agreement. The last stimulus package failed in 2020, likely due to the threat of legal action by independent digital outlet Krautreporter, which lamented the distortion of competition caused by the exclusion of digital outlets. In the private sector, many organisations such as Bertelsmann and Springer have been largely owned by individual families, though there has been an increase in foreign funding, with American company KKR gaining 35.6% of Axel Springer shares to become their largest shareholder. Meanwhile, the willingness of individuals to pay for online content has increased to 14%, allowing for further diversification of funding streams, according to the Reuters Institute for the Study of Journalism’s Digital News Report 2022.

Twenty-four profiles of digital native media organisations from Germany are included in the directory. This includes 11 profiles based on interviews and 13 profiles based on desk research.

Overall online news consumption is on the rise in Germany, overtaking even TV, notes the Reuters Institute’s report. However, digital extensions of existing print and broadcast outlets still form the majority (72%) of the 25 most-accessed digital news outlets. Nonetheless, there is strong diversity and growth in independent digital native news outlets across the country.

In particular, local independent digital initiatives have emerged, such as Karla from Konstanz, VierNull from Düsseldorf or RUMS in Münster. They are relatively new, and still testing different business models. Peer consultations and public funding through structures such as the Journalism Lab in North-Rhine Westphalia or Bavaria Media Lab may provide a road to viability.

These structures have also supported the first steps of digital outlets aimed at migrant communities, such as Nalan Sipar, Karakaya Talks or RosaMag. “There were issues in the pandemic that only affected the German-Turkish community, and the public broadcasters did not even look at those,” says Nalan Sipar, founder of Nalan Sipar Media. There are also multiple outlets such as Medieninsider, Social Media Watchblog, Unbias the News or netzpolitik that focus on insights into or around the media industry itself.

Meanwhile, platforms remain largely traditional, with most outlets distributing primarily via websites, newsletters or social media, with some more personal outlets, such as Groschenphilosophin, experimenting with Telegram channels. The more established, successful digital media organisations such as detektor.fm and Correctiv are noted to be frontrunners in their fields and continue to explore new means of distribution, from YouTube podcasting, to building a network of local journalists to crowdsource information, or growing into the print market through graphic novels or physical magazines.

Most outlets listed subscription models as one of their primary revenue sources, though overall volumes remain low, and many are still unable to fully pay their founders and sometimes even their staff. The emergence of the platform Steady, facilitating subscription models for independent media outlets, has been a strong driver of this trend. Overall, the platform provides a unique way to monetise content and build a dedicated community.

Alternative sources of revenue often include advertising, grants or the production of content for media and non-media organisations and, more recently, explorations towards physical events, city tours or workshops and training.

With many digital news outlets still in their early days, long-term sustainable business models beyond starting capital, acceleration grants and investments by founders are yet to be identified. As detektor.fm co-founder Christian Bollert states: “We set up a very broad business model from the beginning. If we were financed solely by advertising, we would certainly have had to lay people off during Covid-19 or following the Russian war on Ukraine.”

Germany’s digital independent media landscape is diverse, and provides a space for more representative areas, topics and communities that have been largely underrepresented to date. However, the ecosystem is also largely young, with many struggling to identify sustainable business models that can fully finance their operations. The existence of more established examples gives hope that the sector can thrive and survive – especially if subscription models maintain their popularity, and key governmental funding and legal frameworks are established.

Last updated: april 2023

CREDIT FOR STATISTICS: Press Freedom statistics, RSF Press Freedom Index 2022; Internet penetration and population statistics, from Internet World Stats