The digital native media in this study range from tiny start-ups with no revenue to large media organisations that bring in millions of euros each year. That diversity often makes it hard to generalise about what helps them build sustainable news organisations.

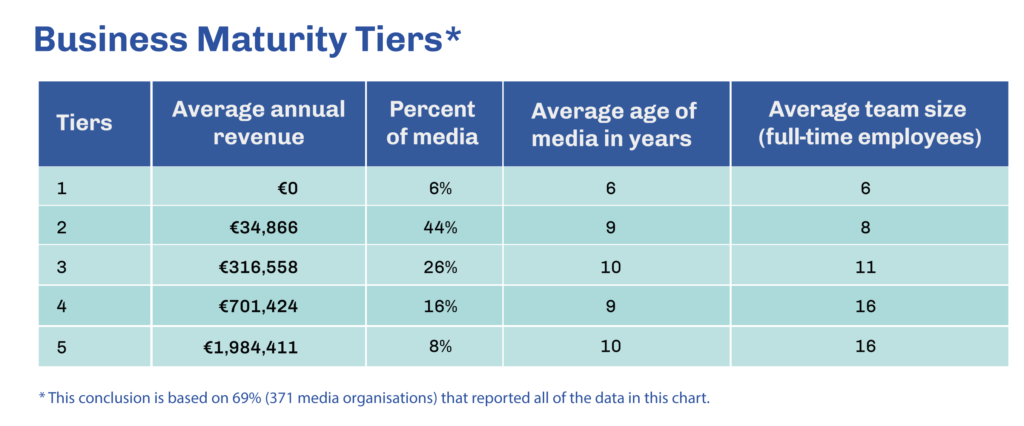

Thus, as we’ve done in similar research projects in other parts of the world, we found that the best way to compare them was to divide them into distinct tiers, or levels, of business maturity. We created these tiers by organising them based on annual revenue, team size (full-time employees) and how many years they have been publishing.

As we’ve expanded our research on digital native media from Latin America to Southeast Asia and Africa, and now to Europe, we have used the same five levels of business maturity to make it easier to compare datasets among our studies.

In this new study on European digital native media, we found that less than 10% of the media qualified for the highest tier (Tier 5), with average annual revenue of nearly €2 million per year. Note: to better reflect the average, we excluded a few outliers which surpassed €10 million in annual revenue.

Nearly half of the publications featured in this research project landed in the lowest tiers (Tier 1 and Tier 2) with annual revenues from 0 to €100,000.

The remainder fell into the mid-tiers (Tier 3 and Tier 4), earning between €100,000 and €1 million per year. As their annual revenues increased, their team sizes increased, as well. But as we’ve found in previous studies in other regions, age can be a misleading factor. Although in general, older media do tend to earn higher revenues, we found relatively young media in the top tiers, and media that were more than 10 years old sometimes still in the lower tiers.

The fact that the age of these media organisations doesn’t always correlate to annual revenue could be attributable to other factors covered in this report, including the amount of initial investment, investment in sales and business development staff, and the experience and focus of the media founders on building sustainable business models.

Note: To protect the privacy of these media organisations, we did not publish their annual revenues in the profiles in the Project Oasis media directory, but many of them disclose detailed financial information on their own websites.

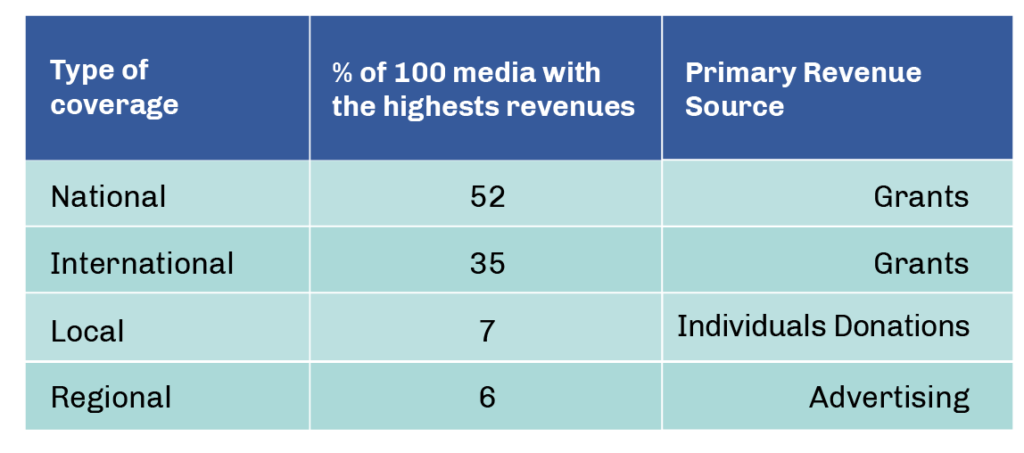

Media outlets that cover national and international news reported the highest revenues

The 100 media outlets with the highest annual revenues in this study primarily cover national news (52%) and international news (35%). Grants were the primary revenue source for media featuring both these types of coverage, especially among non-profit media organisations. For-profit media organisations in the highest revenue tiers cited advertising as their primary revenue source.

Media that focused on local coverage (7% of the highest earners) and regional coverage (6%) reported individual donations and advertising, respectively, as their primary revenue sources.

Social media platforms drive revenue for top earners

As we dug deeper into the characteristics of the 100 media organisations with the highest annual revenues in this study, we explored the platforms they used to distribute information, and found that many went beyond news websites and used social media, newsletters and podcasts to engage audiences.

Of the top revenue producers, 46 attract more traffic to their content through social media platforms, followed by 34 that attract traffic primarily to content on a website, 11 that reach audiences primarily through podcasts and nine which cited newsletters as their main distribution channel.

It is important to note that these findings do not necessarily mean that these media earn the majority of their revenue through social media, but we did find that large social media audiences correlated to higher overall revenues. We also found it notable that media that primarily publish information through podcasts and newsletters were among the top revenue earners.

When we analysed the 200 media organisations with the highest annual revenues, social media platforms and websites remained in first and second place as the top news distribution methods, while newsletters overtook podcasts in third and fourth place.

In Germany, our researcher found five media outlets which primarily publish content via newsletters. A particular standout is Buzzard, an initiative established in 2020 by Dario Nassal and Felix Friedrich, to provide “a daily dose of diverse perspectives”. During their studies in politics, the founders became increasingly aware of the rising polarisation in public debate, and how difficult it was to access an overview of different political perspectives.

The outlet was launched with an investment of nearly €20,000, as well as €165,000 from a crowdfunding campaign and multiple support schemes. Today, it uses over 2,000 verified sources, including established media outlets, think tanks and activist sites, and curates perspectives from across the political spectrum.

Its community can give feedback to the team about its indexed and curated content, although key or frequently appearing feedback is also passed on to the advisory board, which comprises six people.

Buzzard’s content is accessible via an app, a podcast and a weekly newsletter. Though it is largely member financed, its strict paywall has recently been lifted, giving guests access to the app and content insights via its website. Amid popular demand from teachers, Buzzard collaborates with philanthropic organisations to offer schools a new, easy way to strengthen discussion, culture and media literacy, and to integrate diverse perspectives on current debates into their curriculum.

Launched in February 2020, the Polish news initiative Raport o Stanie Swiata (Report on the State of the World) produces the State of the World Report, a weekly dose of new stories, commentaries and columns about world events, as well as Report for Today, a weekly podcast that takes a deeper dive into one newsworthy event every Wednesday. It also produces other podcasts on topics such as books, theatre and music productions, as well as the future (specifically, how the world is changing). The platform is financed by listeners through individual donations.

How digital native media earn revenue

As we selected the digital native media for this research project, we sought out media that serve the public interest, and paid special attention to publications that reach underserved communities or fill news deserts.

This focus may help to explain why more than half of the media in this study are non-profit organisations, and why grant funding emerged as the primary source of revenue reported by the media leaders we interviewed.

It’s also important to note that for-profit and non-profit media outlets reported different revenue sources.

The primary revenue source reported by non-profit publishers was grants, followed by individual donations and memberships (in that order).

By comparison, the primary revenue source reported by for-profit publishers was advertising, followed by website subscriptions and grants (in that order).

These insights are based on an analysis of the 513 media that answered our questions regarding tax status and primary revenue source.

Out of these 513 media, 264 are non-profit, while 170 are for-profit. Meanwhile, 48 use a hybrid model (which incorporates for-profit and non-profit elements), and just 31 are initiatives that were not yet incorporated or registered when we completed our research.

In the Project Oasis digital media directory, which accompanies this report, you can see the top revenue sources across all of the media in the directory, as well as the percentage of non-profit vs for-profit organizations.

Note that as we continue to add media to the directory with different revenue sources these numbers may change in the future.

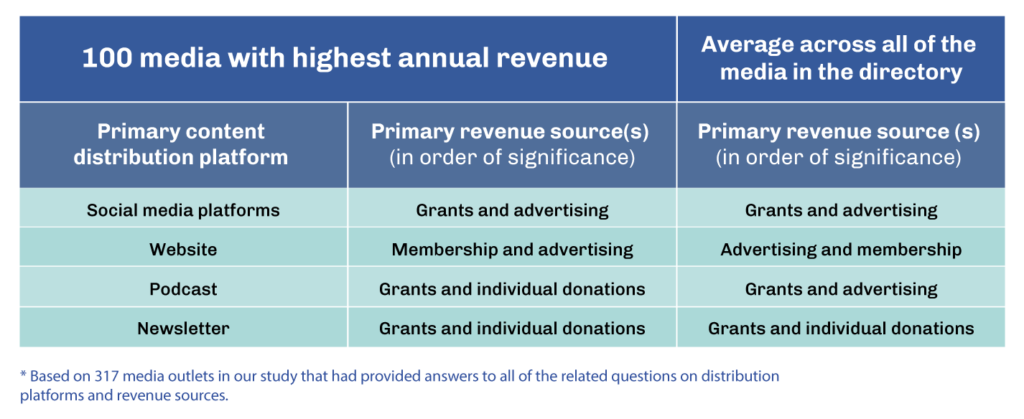

The relationship between sources of revenue and publishing platforms

Diving deeper into the sustainability of the 100 media with the highest annual revenues, we examined how their primary revenue sources compare with the platforms they use to publish and distribute content.

As you can see in the table below, we found that grants were the primary source of revenue for media that rely on social media distribution, newsletters and podcasts, but membership revenue and advertising revenue stood out for outlets that distribute their information primarily on their own website.

The higher the page views, the higher the annual revenue

Consistent with our research in other markets, there is a direct relationship between the number of page views a news website attracts and its annual revenue.

This finding was especially notable among media that rely on advertising as their primary source of revenue.

How annual revenue correlates to the diversification of revenue sources

Throughout all of SembraMedia’s research projects examining independent digital native media, we have found that developing diverse sources of revenue fosters media independence and sustainability.

Consistently, the data has shown that having fewer than two revenue sources was likely to land media organisations in the bottom third of revenue earners in most markets, but having more than six revenue sources did not always increase revenue among similar-sized media organisations. The ideal number in most markets seems to be between two and six distinct revenue sources.

Although the diverse range of political and economic realities across the more than 40 countries included in this study made it more challenging to confirm this trend in Europe, we did find that the media in this study with the highest reported annual revenues rely on two to four active sources of revenue.

When we compared revenue sources among media in different countries, Italy stood out as the country with the greatest diversity, with digital media there reporting an average of 13 revenue sources. However, Italy came in seventh out of the countries with the highest annual revenue, reinforcing the finding that having too many revenue sources is not necessarily financially beneficial.

In Georgia and Croatia, some media outlets rely significantly on funding from private donors or from national and foreign governments. However, our researchers in both countries found organisations that are working to diversify their revenue sources with the goal of breaking with this precedent and building sustainable, commercial media outlets. Examples include On.ge and Project 64 in Georgia, and Srednja.hr in Croatia. Srednja.hr covers high school students, identifying them as an underrepresented group in national news coverage. It relies primarily on advertising to generate revenue.

How digital media build reader revenue

Many of the media outlets we studied turn to their audiences for financial support. For some, reader revenue is a means of operating within an environment where media capture is widespread, while others seek audience support to build a sense of community and collectivism.

“Readers should donate because they feel they are part of a community, not because they are forced to do it,” said Alberto Puliafito, co-founder of the Italian multimedia publication Slow News.

Some media organisations have launched membership programmes, but only a few reported using a paywall to restrict audience access.

That said, only about 30% of the media in our directory reported receiving reader revenue. For the purposes of this research, we included financial contributions from memberships, donations, subscriptions (to a website or newsletter), crowdfunding and event ticket sales as reader revenue or audience support.

Membership models were slightly more popular with the publications we studied, compared to website subscriptions. It is worth noting that the terms “membership” and “subscription” are often subject to regional and language interpretations. In some countries, “subscription” is used for a model that often includes community participation in non-financial ways, as well as financial. Some 41% of the media we studied have membership models, but the majority reported having fewer than 10,000 paid members.

Website subscriptions are used by almost 25% of the media outlets that employ reader revenue. Most of these also reported fewer than 10,000 subscribers.

In some cases, readers pay to access or contribute to a specific section of a media’s website. Czech outlet Deník Referendum, which was established in 2009, has the following slogan: “No oligarchs, no paywall. Just your donations and our work.”

Editor-in-chief Jakub Patočka came up with a specific method: “Readers who wish to debate under our articles pay a fee. This approach generates a modest income and also helps cultivate the discussion in the comments section.”

Media cooperatives are also an interesting model among publications in our directory. As cooperatives, The Bristol Cable and The Meteor in the UK, Onderzoekscollectief Spit in the Netherlands, and RiffReporter in Germany are financed through contributions from members of the cooperative.

The Bristol Cable’s cooperative members are also “democratic shareholders”, which means they can attend the organisation’s annual general meetings, vote on editorial campaigns and stand in elections for the non-executive directors’ board. The board members help to guide, advise and steer the outlet forward.

Reader revenue, closely intertwined with community engagement, is also popular among digital native media outlets based in countries where media capture is widespread. Some of the examples you can find in our media directory include: OKO.press and Raport o Stanie Swiata in Poland, Telex and Mérce in Hungary, and Alternativata in Bulgaria.

Despite the relatively small numbers of membership and subscription programmes we found among media throughout Europe, when we asked the media leaders we interviewed for this study if they were planning to add any new revenue sources in the upcoming year, more than half said “yes”. This number was even higher among those that had only one revenue source, or none. Many of them indicated reader revenue would be a focus, particularly membership and website subscriptions.

Media outlets that publish in English tend to have higher revenue

Europe is a linguistically diverse region, with the European Union alone boasting 24 official languages. During the course of this research, our team conducted interviews in more than 30 languages.

As we analysed the implications of this linguistic diversity, we looked at the most commonly used languages among independent digital native media in Europe, and how publishing in different languages related to annual revenue rates.

The most common languages used to share information, among the 100 media outlets in our directory that reported the highest annual revenues, were, in descending order: English, German, Spanish, French, Polish, Italian, Swedish, Danish, Czech and Finnish. These publications reported an average annual revenue of €691,234.

Note: this finding refers to media that publish in these languages, regardless of whether or not they are based in, or cover, a country where the language is the primary (or native) language. In other words, media outlets that publish content in English have higher revenue, but these organisations are not necessarily based in countries that have English as a first language.

Digital native media often publish information in more than one language

Some independent digital native media outlets told our researchers that they publish information in other languages to reach underserved communities.

In Georgia, some outlets have identified a need to create original content for ethnic minority groups in their first languages, in order to decrease their dependency on information sources from outside the country. In order to create and distribute multi-language content, partnerships were formed among various media outlets to adapt, translate and publish each other’s content.

In Armenia, Xirat is the only digital platform in the country that covers the life of national minorities in the Yazidi language, covering the unique culture, traditions, religion, art and history of the Yazidi communities that reside there.

In Latvia, many Russian-language outlets, including the bilingual news platform Meduza, serve the Russian minority population in the Baltics, as well as Russian-speaking audiences globally.

More than 250 of the media in our directory, across 38 countries, publish content in languages other than English. Nearly 28% of these are in Germany, Bulgaria, Portugal, Italy and the Czech Republic.

For nearly 15% of the media that publish in languages other than English, the primary revenue source is grants, with grants from local and national government, and other connected governmental institutions, being the biggest contributor. This is followed by advertising at 13%, and website subscriptions at just over 5%.

Our team of researchers conducted many of their interviews in the primary language(s) of each country, and then translated the information into English before adding the data to our directory and country summaries. To find out more about our methodology and how data was collected and analysed, visit the About The Study section.

Translating content into English to reach a global audience

Many of the media organisations we interviewed said they translate their content into English to extend their reach, often sharing their translations with other publications.

For example in Georgia, multimedia and investigative outlet OC Media partners with six other outlets to translate and re-publish its English-language content in Georgian, Azerbaijani, Armenian and Russian.

JAMnews, which brings together professional journalists, authors and experts from around the Caucasus, is part of the Russian Language News Exchange initiative. The outlet exchanges content with independent newsrooms from Eastern Europe and Central Asia for its pentalingual website.

Some 183 media across 36 countries publish content in one or more languages, in addition to English:

- We found more than 50 examples of media that translate content into English in Armenia, Ukraine, Bosnia and Herzegovina and Italy, which likely reflects their need to reach an international audience. By comparison, of the media we include from the United Kingdom, only 2% publish in a language other than English.

- More than 36% of media that translate their content report grants as their primary revenue source, with funding from private donor organisations cited as the biggest contributors. This is followed by memberships at 6%, and advertising at 5.5%.

- Almost 65% of media that publish in multiple languages are non-profit. Nearly 18% are for-profit, and almost 11% have a hybrid for-profit and non-profit model.

(Note: The percentages do not always add up to 100% because we are not listing all of the categories in these sections.)